Young adults put pandemic savings toward down payment

Three in five young adults plan to use money they have saved during the COVID-19 pandemic to put towards a down payment on a home, according to a Zillow survey, showing that homeownership remains a strong aspiration even among what has often been called the “rent forever” generation.

While almost three million millennials and Gen Zers have been forced to move back in with their parents, more than eight in 10 survey saved extra cash they would have normally spent such things as shopping, entertainment and vacations since the pandemic began. When asked what they will do with that extra cash, 64% said they would use it for their everyday living expenses, while a sizable 59% said they intend to put some of it towards a down payment on a home.

- About 3-in-5 young adults plan to use money saved during the pandemic toward a down payment on a home – the most common answer behind paying for everyday living expenses.

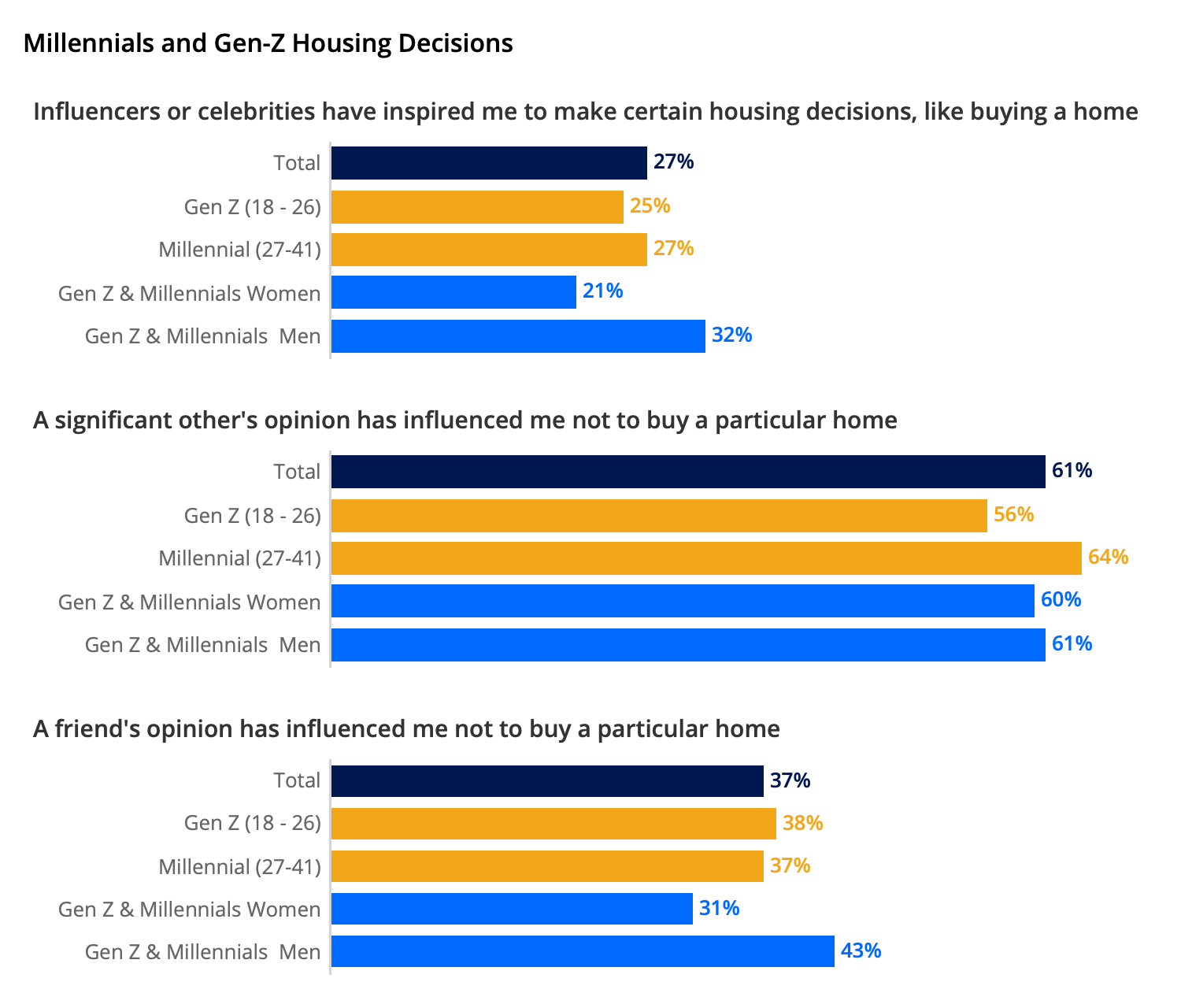

- Around a quarter say social media influencers and celebrities impacted their housing decisions. Men are more likely than women to say influencers inspired their choices.

- A majority of young adults discuss their housing decisions with their parents (71%,) before making a purchase, while 61% talk it over with friends.

………………..

About 3 in 5millennials and Gen Zers plan to use money saved during the pandemic toward a down payment on a home, according to a Zillow survey, showing that even in an unprecedented global pandemic, homeownership still appears to be a priority and aspiration among those sometimes called the”rent forever generation.”

Many young adults, particularly women and BIPOC, were not fortunate enough to have the kinds of jobs better suited to weathering the pandemic economy and were disproportionately impacted by the pandemic, andalmost 3 million moved back homesince spring 2020. Those who remained employedwere able to savemoney they would have otherwise spent on things like shopping, vacationing and childcare costs. Of the more than 1,200 young adults surveyed by Zillow, 83% reported they saved money in at least one spending category during the pandemic. When asked about what they plan to do with the extra cash saved up during that time, the majority (64%) said they plan to use it for everyday living expenses, followed by 59% saying they planned to use their savings for a down payment on a home.

Millennials are the largest generational group of home buyers and, thus, have an outsized impact on the market as a whole. As more millennials age into their peak home buying years, with Gen Z not far behind, Zillow’s survey of young adults and potential first-time home buyers asked what they value in their home shopping decisions, including where they want to live, what they are looking for in a home and who or what influences them most when it comes to choosing their first home.

Who and What Influences Millennials and Gen-Z Housing Choices?

It’s widely said thatinfluencers and celebrities wield a great deal of power over the purchasing decisions of millennials and Gen-Zers. This trend also shines through as it pertains to deciding to purchase a home. Zillow research shows that 27% of young adults have been inspired by influencers or celebrities to make certain housing decisions, including buying a home. Men were more likely than women to report that influencers or celebrities have inspired them to make certain housing decisions. About a third (32%) of men ages 18-41 said so, compared to just 21% of women.

Regarding their preferred home location, about 44% of young adults said they somewhat or completely preferred a home in a remote area, while a third (36%) said the same about a home in a big city. One in five (20%) said they had no preference. And despite the recent rise in opportunities for millions of Americans to permanently work from home, most still consider living close to work (61%) and having a short commute to work (63%) very or extremely important when considering where to purchase a home.

When it comes to the decision making process around purchasing a home, including the financial aspects and deciding on home features, most millennials and Gen-Zers report discussing their housing decisions with their parents (71%) and friends (61%). Half discuss their housing decisions with their siblings, while not quite a third (29%) discuss with their grandparents. They were least likely to report discussing their housing decisions with their social media followers – only 16% reported doing so.

Among millennials and Gen-Zers who already own a home or have tried to buy one, most reported that the opinion of a significant other (60%) or parent (54%) influenced them not to buy a particular home. A smaller share (38%) said the same about a friend’s opinion.

Forecasts there will be 6.4 million more households formed by 2025 as a result of a huge wave of millennials now hitting their mid-to-late 30s and aging into their prime home buying years. About a third (32%) of Gen-Zers and millennials reported that at least some of their friends have already purchased a home.