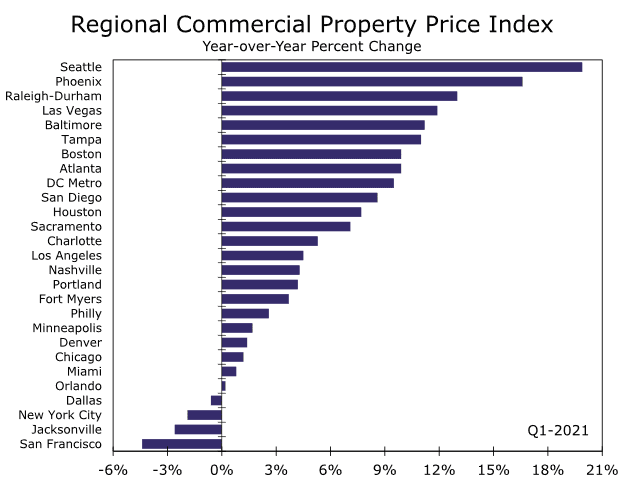

The resurgence in economic activity looks to be a harbinger for a turnaround in commercial real estate fundamentals. At the end of this commentary is a chart of Regional Commercial Property Price Index

APARTMENTS

The apartment market is rapidly rebounding. Vacancy rates plummeted in Q1 alongside a jump in leasing activity. Effective rents jumped 2.3%, which is the strongest quarterly gain since at least 2002. Conditions should continue to improve this year alongside robust job growth and what looks like the imminent return to the office. For the most part, rents in the urban areas most severely impacted by the pandemic, such as New York City and San Francisco, are still below pre-pandemic levels. With a return to the office now in sight, however, rent in these areas are rapidly climbing higher. Apartment demand is improving almost everywhere but is especially strong in more affordable markets, such as Phoenix, Tampa, Charlotte, and the Inland Empire

OFFICE

The return to the office is now under way, but the office market is still dealing with the aftershocks from the shift to remote work. Businesses appear to be seeking out flexible office space to better accommodate hybrid work models, which will likely slow the growth of office demand going forward. Demand for new office space remains incredibly weak. Businesses continue to sublease space at a record clip. A sharp rise in the vacancy rate, which spiked to a post-pandemic high of 11.9%. Asking rents declined 0.1% during Q1. The pandemic has accelerated the outflow of tech investment from costly coastal markets to more affordable areas around the country. Office rents in San Francisco, San Jose and Seattle continue to sharply decline.

RETAIL

With vaccinations widespread, people are shopping and dining out again, which is boosting demand for retail space. Subsequently, retail asking rent growth entered positive territory in Q1. Consume spending is set to surge this year which will bolster retail development with restaurants, gyms, and other high-contact tenants.

INDUSTRIAL

The ongoing shift to e-commerce will continue to fuel robust demand for warehouses, industrial space and data centers. Industrial demand has also been boosted by the supply chain bottlenecks that have led manufacturers to re-shore production and keep more inventory on hand. Industrial property vacancy rates decline to 5.4% in Q1.