The U.S. economy added about 175,000 jobs in April, lower than the expected number of around 233,000. While this is still considered a strong jobs report, wage growth eased – a sign that the rise in prices of everyday costs like groceries, rent, and gas might slow down in the future. That’s the first good economic news for mortgage rates since monthly inflation began creeping back up in January.

“This is the type of jobs report we were all wishing for,” says Zillow Senior Economist Orphe Divounguy. “Jobs support housing demand, and rising residential construction employment means more supply is underway. Easing wage inflation takes some pressure off the Fed to consider another rate hike.”

Yearly home values are up in 47 of the 50 largest metros

The typical mortgage payment is up 11.6% from last year and 113% since pre-pandemic. Persistent affordability challenges underscore the importance of having clients work with a loan officer earlier in the homebuying process. Zillow research shows the best time for the buyer to have that conversation is after the first meeting with you.

Amid these affordability challenges, housing supply continues to increase, giving potential buyers more options compared to a year ago. In April, the flow of homes onto the for-sale market was up 15.5% from a year ago. That was an improvement from March, when newly listed resale inventory was up just 3.8% from March 2023. In April, total for-sale inventory was up 18% year over year.

“While affordability remains a major challenge, the recent rise in new listings and inventory should help curb price growth and the rise in monthly housing costs,” Divounguy says.

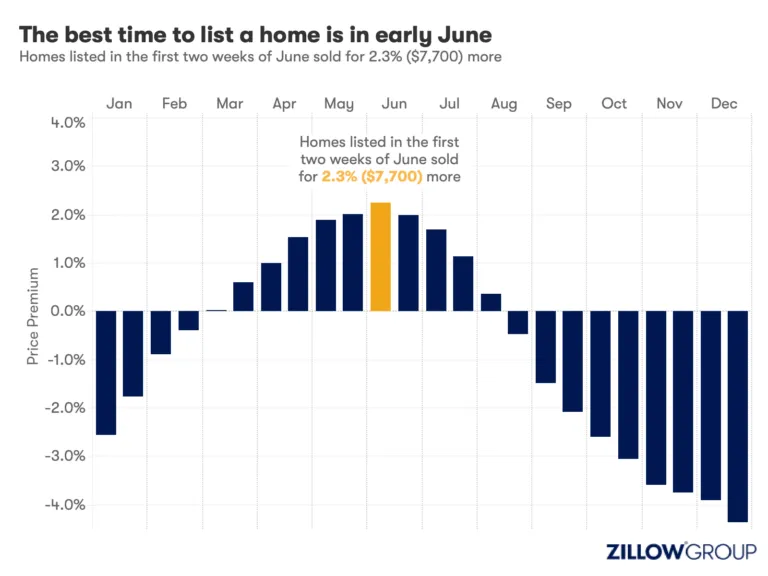

Homes listed in early June sold for $7,700 more

Despite the affordability challenges buyers are facing, appropriately priced homes went pending in just 13 days during April.Spring sellers looking to maximize their sale price should be ready to list. Homes that hit the market in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical home, according to aZillow analysis of 2023 home sales.

Despite the affordability challenges buyers are facing, appropriately priced homes went pending in just 13 days during April.Spring sellers looking to maximize their sale price should be ready to list. Homes that hit the market in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical home, according to aZillow analysis of 2023 home sales.

“The old logic was that sellers could earn a premium by listing in late spring, when their home would be on the top of the pile of listings during peak search activity,” says Zillow Chief Economist Skylar Olsen. “As we put the market disruption behind us and inventory climbs out of the pandemic inventory drought, mortgage rate fluctuations still may have the power to make their own seasonality.”

After rising in April, mortgage rates dropped slightly in the first two weeks of May. First-time buyers on the fence may dip in and out of the market, depending on those rates.

Most sellers make two or more improvements before listing

Certain home features can help a home sell faster and for more money. Mentioning an outdoor TV, outdoor shower, or outdoor kitchen in a listing can help homes sell for as much as3.1% more than expected. And fresh features are replacing old favorites. Soapstone countertops and beverage centers are outperforming quartz counters and wine fridges in 2024.

Zillow research finds that most sellers make at least two improvements before listing their home. Interior painting is one of the most common, but it pays to be strategic when your clients pick colors. Homes with a charcoal gray kitchen can sell for about $2,500 more. A dark gray living room can bring in offers of $1,755 or more. Dark gray in the bedroom outperformed pale neutrals, with the potential to bring in offers of $1,859 more. Matte black finishes can also help a home sell for 3.1% more.