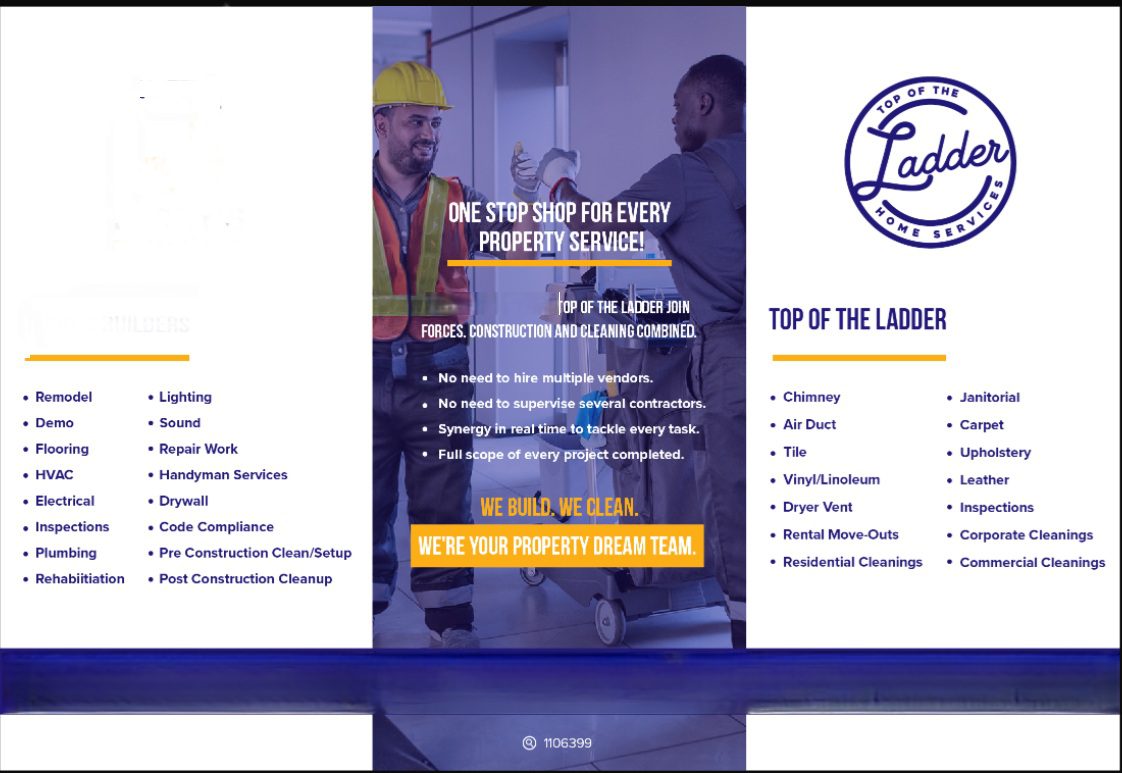

TOP OF THE LADDER

Fix and Finance Finanace Your Property to sell, after buying or keeping.

CONSTRUCTION + CLEANING = YOUR PROPERTY DREAM TEAM GET YOUR PROPERTY MARKET-READY

GET YOUR PROPERTY MARKET-READY

Selling your home? Buying a fixer-upper? We’ve got you covered.

Whether you’re prepping to list, or you’ve just bought a home that needs work, we handle everything — from repairs to cleanup.

PRESALE PREPARATION SERVICES

Maximize your home’s value before you list:

- Quick Remodels & Cosmetic Upgrades

- Code Compliance Checks

- Lighting, Flooring & Paint Touch-ups

- Deep Cleaning: Carpets, Vents, Windows & More

- Exterior Curb Appeal Enhancements

- Pre-Inspection Repairs

INVESTOR & FIXER-UPPER SOLUTIONS

Just closed on a fixer? We’ll bring it back to life.

- Full Home Renovations

- Plumbing & Electrical Overhaul

- Drywall, Flooring & Paint

- Post-Reno Deep Clean

- Rental-Ready Turnaround Services

FINANCING AVAILABLE

Need to spread out the cost? Ask us about financing options to make your upgrades or repairs more affordable.

Creative Solutions for Sellers: Making the Most of a Home Before It Hits the Market

Not every home is ready for market the moment the decision to sell is made – and not every seller has the resources, time, or energy to get it there on their own.

Sometimes it’s small things: scuffed walls, dated lighting, a broken cabinet door. Other times it’s a bit more involved – worn floors, a tired kitchen, or repairs flagged in a recent inspection. These aren’t “fixer-uppers,” but they also aren’t show-ready. So the question becomes: what’s worth doing before listing, and how can it get done?

At County Properties, we’ve seen sellers leave a lot of potential value on the table simply because they didn’t have the budget to make updates or didn’t want to deal with the logistics of getting them done. That’s where flexible, tailored support behind the scenes can make a difference.

Here are a few solutions that are starting to gain traction:

- Pre-Sale Improvements with No Upfront Cost

For sellers who have equity but not cash on hand, pre-sale improvements can often be financed and paid back through escrow. This allows strategic updates – like refinishing floors, updating paint, or refreshing landscaping – to get done without financial stress, while still boosting the home’s market value and buyer appeal.

- One-Stop Project Management

Instead of hiring and managing multiple vendors, sellers (or their agents) can bring in a team that handles everything from light repairs and cosmetic updates to staging and final clean-up. This creates a smoother process for everyone and keeps timelines tight – especially important in a shifting market.

- Value-Sharing Agreements

In some cases, improvements can be done in exchange for a percentage of the uplift in sale price – aligning everyone’s interests and making more ambitious updates possible, even without upfront cash.

- Investor Buyouts for Unique Situations

In situations where time is critical or the property isn’t market-ready, some sellers may benefit from a fast, as-is sale to a reputable investor. While this isn’t for everyone, it can be a good option for clients facing financial strain, inherited properties, or homes with deeper repair needs.

A More Flexible Way Forward

The goal in all of this isn’t to over-improve or overthink – it’s to help sellers make confident, informed choices about how to present their home. With the right support and structure, even small improvements can lead to faster sales, higher offers, and smoother transactions.

At County Properties, we believe in offering not just guidance, but options. Because no two sellers (or homes) are alike.

WE BUILD. WE CLEAN. WE GET IT SOLD.